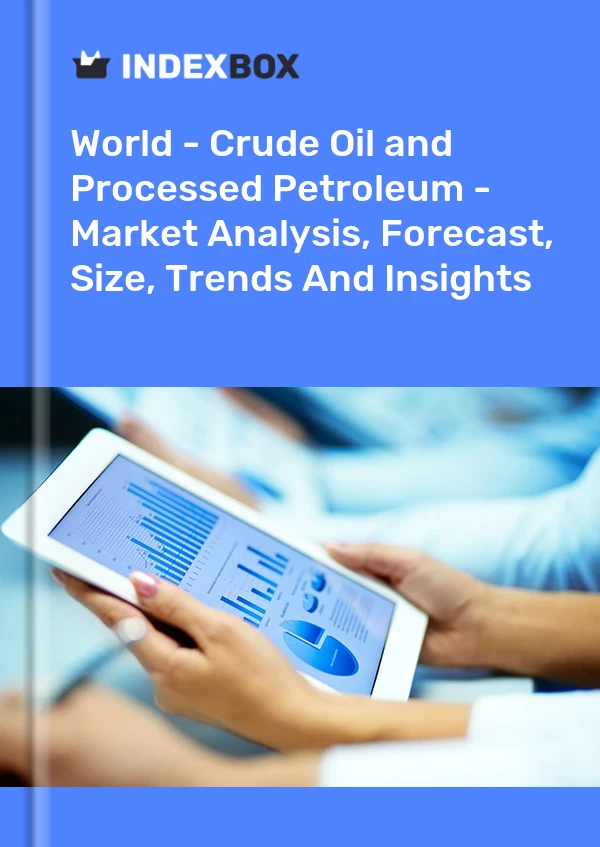

World - Crude Oil and Processed Petroleum - Market Analysis, Forecast, Size, Trends And Insights

Get instant access to more than 2 million reports, dashboards, and datasets on the IndexBox Platform.

View PricingPrice of Crude Oil on the Stock Market

The price of crude oil on the stock market is subject to various factors and can fluctuate significantly over time. It is important for investors and traders to closely monitor these price movements as they can have a significant impact on the global economy and individual companies within the oil industry.

Factors Affecting Crude Oil Prices

Crude oil prices are influenced by a complex array of factors that can broadly be categorized into supply and demand dynamics, geopolitical events, and market sentiment.

Supply and Demand Dynamics

Supply and demand dynamics play a significant role in determining crude oil prices. When global oil production exceeds demand, it creates a surplus and tends to lower prices. Conversely, when demand outstrips supply, it results in a deficit and tends to raise prices. Various factors can impact supply and demand, including:

- Production Levels: Any disruptions in major oil-producing regions, such as conflicts, sanctions, or natural disasters, can significantly impact supply. Conversely, increased production from major producers, such as the Organization of the Petroleum Exporting Countries (OPEC), can influence prices.

- Economic Growth: Economic growth impacts oil demand, with periods of strong economic growth tending to boost demand and, consequently, prices.

- Seasonal Demand: Demand for crude oil tends to be higher in certain seasons, such as during the summer months when people travel more and consume more fuel.

- Storage Levels: The levels of oil inventories in storage facilities can impact prices. High inventory levels can indicate an oversupply and put downward pressure on prices, while low inventory levels can suggest a deficit and put upward pressure on prices.

Geopolitical Events

Geopolitical events can have a significant impact on crude oil prices as they can disrupt supply or create supply uncertainties. Some examples of geopolitical factors that influence oil prices include:

- Wars and Conflicts: Regional conflicts, such as those in the Middle East, can disrupt oil production and transportation, leading to supply disruptions.

- Sanctions: The imposition of sanctions on major oil-producing countries can limit their ability to export oil, reducing global supply.

- Political Instability: Any political instability in major oil-producing regions can create uncertainties surrounding oil supply, which can impact prices.

Market Sentiment

Market sentiment and investor psychology can also influence crude oil prices. If investors believe that oil prices will rise in the future, they may increase their demand for oil contracts, driving up prices. Alternatively, if investors anticipate a decline in oil prices, they may sell their contracts, leading to a decrease in prices. Factors that can impact market sentiment include:

- Speculation: Speculative trading in oil futures can create volatile price movements as traders buy and sell contracts based on their predictions of future price movements.

- Financial Markets: Macroeconomic factors, such as interest rates, inflation, and currency exchange rates, can impact market sentiment towards oil and influence prices.

Impact on the Global Economy

The price of crude oil has a significant impact on the global economy due to its central role as a source of energy and raw material for various industries. Fluctuations in oil prices can have the following effects:

- Inflation: As the price of crude oil rises, it increases the costs of production and transportation, leading to higher prices for goods and services, contributing to inflation.

- Consumer Spending: Higher oil prices can lead to increased gasoline and energy costs, reducing disposable income and affecting consumer spending.

- Business Costs: Oil is a key input for many industries, and higher prices can increase the cost of production and reduce profit margins for businesses, potentially leading to layoffs or reduced investment.

- Exchange Rates: Oil prices can influence exchange rates as they impact the trade balances of oil-importing and oil-exporting nations.

It is worth noting that the price of crude oil on the stock market refers to the futures contracts for oil, rather than the physical delivery of oil itself. Investors and traders can speculate on future oil prices by buying and selling these futures contracts, which are traded on exchanges such as the New York Mercantile Exchange (NYMEX) and the Intercontinental Exchange (ICE).

Overall, the price of crude oil on the stock market is influenced by a wide range of factors and has significant implications for the global economy and various industries. Monitoring and analyzing these price movements is crucial for investors and traders seeking to navigate the complex dynamics of the oil market.

This report provides an in-depth analysis of the global market for crude oil and processed petroleum. Within it, you will discover the latest data on market trends and opportunities by country, consumption, production and price developments, as well as the global trade (imports and exports). The forecast exhibits the market prospects through 2030.

Product coverage:

Country coverage:

Worldwide - the report contains statistical data for 200 countries and includes detailed profiles of the 50 largest consuming countries:

- USA

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

+ the largest producing countries

Data coverage:

- Global market volume and value

- Per Capita consumption

- Forecast of the market dynamics in the medium term

- Global production, split by region and country

- Global trade (exports and imports)

- Export and import prices

- Market trends, drivers and restraints

- Key market players and their profiles

Reasons to buy this report:

- Take advantage of the latest data

- Find deeper insights into current market developments

- Discover vital success factors affecting the market

This report is designed for manufacturers, distributors, importers, and wholesalers, as well as for investors, consultants and advisors.

In this report, you can find information that helps you to make informed decisions on the following issues:

- How to diversify your business and benefit from new market opportunities

- How to load your idle production capacity

- How to boost your sales on overseas markets

- How to increase your profit margins

- How to make your supply chain more sustainable

- How to reduce your production and supply chain costs

- How to outsource production to other countries

- How to prepare your business for global expansion

While doing this research, we combine the accumulated expertise of our analysts and the capabilities of artificial intelligence. The AI-based platform, developed by our data scientists, constitutes the key working tool for business analysts, empowering them to discover deep insights and ideas from the marketing data.

-

1. INTRODUCTION

Making Data-Driven Decisions to Grow Your Business

- REPORT DESCRIPTION

- RESEARCH METHODOLOGY AND AI PLATFORM

- DATA-DRIVEN DECISIONS FOR YOUR BUSINESS

- GLOSSARY AND SPECIFIC TERMS

-

2. EXECUTIVE SUMMARY

A Quick Overview of Market Performance

- KEY FINDINGS

- MARKET TRENDS This Chapter is Available Only for the Professional Edition PRO

-

3. MARKET OVERVIEW

Understanding the Current State of The Market and Its Prospects

- MARKET SIZE

- CONSUMPTION BY COUNTRY

- MARKET FORECAST TO 2030

-

4. MOST PROMISING PRODUCT

Finding New Products to Diversify Your Business

This Chapter is Available Only for the Professional Edition PRO- TOP PRODUCTS TO DIVERSIFY YOUR BUSINESS

- BEST-SELLING PRODUCTS

- MOST CONSUMED PRODUCT

- MOST TRADED PRODUCT

- MOST PROFITABLE PRODUCT FOR EXPORT

-

5. MOST PROMISING SUPPLYING COUNTRIES

Choosing the Best Countries to Establish Your Sustainable Supply Chain

This Chapter is Available Only for the Professional Edition PRO- TOP COUNTRIES TO SOURCE YOUR PRODUCT

- TOP PRODUCING COUNTRIES

- TOP EXPORTING COUNTRIES

- LOW-COST EXPORTING COUNTRIES

-

6. MOST PROMISING OVERSEAS MARKETS

Choosing the Best Countries to Boost Your Exports

This Chapter is Available Only for the Professional Edition PRO- TOP OVERSEAS MARKETS FOR EXPORTING YOUR PRODUCT

- TOP CONSUMING MARKETS

- UNSATURATED MARKETS

- TOP IMPORTING MARKETS

- MOST PROFITABLE MARKETS

7. GLOBAL PRODUCTION

The Latest Trends and Insights into The Industry

- PRODUCTION VOLUME AND VALUE

- PRODUCTION BY COUNTRY

8. GLOBAL IMPORTS

The Largest Importers on The Market and How They Succeed

- IMPORTS FROM 2012–2023

- IMPORTS BY COUNTRY

- IMPORT PRICES BY COUNTRY

9. GLOBAL EXPORTS

The Largest Exporters on The Market and How They Succeed

- EXPORTS FROM 2012–2023

- EXPORTS BY COUNTRY

- EXPORT PRICES BY COUNTRY

-

10. PROFILES OF MAJOR PRODUCERS

The Largest Producers on The Market and Their Profiles

This Chapter is Available Only for the Professional Edition PRO -

11. COUNTRY PROFILES

The Largest Markets And Their Profiles

This Chapter is Available Only for the Professional Edition PRO- United States

- China

- Japan

- Germany

- United Kingdom

- France

- Brazil

- Italy

- Russian Federation

- India

- Canada

- Australia

- Republic of Korea

- Spain

- Mexico

- Indonesia

- Netherlands

- Turkey

- Saudi Arabia

- Switzerland

- Sweden

- Nigeria

- Poland

- Belgium

- Argentina

- Norway

- Austria

- Thailand

- United Arab Emirates

- Colombia

- Denmark

- South Africa

- Malaysia

- Israel

- Singapore

- Egypt

- Philippines

- Finland

- Chile

- Ireland

- Pakistan

- Greece

- Portugal

- Kazakhstan

- Algeria

- Czech Republic

- Qatar

- Peru

- Romania

- Vietnam

-

LIST OF TABLES

- Key Findings In 2023

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Per Capita Consumption, By Country, 2018–2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country Of Destination, 2012–2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, By Country Of Origin, 2012–2023

-

LIST OF FIGURES

- Market Volume, In Physical Terms, 2012–2023

- Market Value, 2012–2023

- Consumption, By Country, 2023

- Market Volume Forecast to 2030

- Market Value Forecast to 2030

- Products: Market Size And Growth, By Type

- Products: Average Per Capita Consumption, By Type

- Products: Exports And Growth, By Type

- Products: Export Prices And Growth, By Type

- Production Volume And Growth

- Exports And Growth

- Export Prices And Growth

- Market Size And Growth

- Per Capita Consumption

- Imports And Growth

- Import Prices

- Production, In Physical Terms, 2012–2023

- Production, In Value Terms, 2012–2023

- Production, By Country, 2023

- Production, In Physical Terms, By Country, 2012–2023

- Imports, In Physical Terms, 2012–2023

- Imports, In Value Terms, 2012–2023

- Imports, In Physical Terms, By Country, 2023

- Imports, In Physical Terms, By Country, 2012–2023

- Imports, In Value Terms, By Country, 2012–2023

- Import Prices, By Country, 2012–2023

- Exports, In Physical Terms, 2012–2023

- Exports, In Value Terms, 2012–2023

- Exports, In Physical Terms, By Country, 2023

- Exports, In Physical Terms, By Country, 2012–2023

- Exports, In Value Terms, By Country, 2012–2023

- Export Prices, 2012–2023

This report provides an in-depth analysis of the global market for crude oil and processed petroleum.

This report provides an in-depth analysis of the global crude oil market.